How to Ensure a Big Tax Refund Next Year

The number one thing to do when you want to receive a tax refund next tax season is to start planning as soon as possible. The choices you make today impact how much you’ll owe – or, hopefully, how much you’ll get back – next year, so the sooner you start accurately documenting your deductions and using sound financial planning strategies, the better prepared you’ll be whether you owe Uncle Sam or are owed a return. Below are some tips to help you get ready for a big tax refund next year.

Seek Advice from a Tax Accountant or CPA

You’ve decided to get your taxes together and organized this year so you can get a big tax refund next year. That means no more pulling your hair out while trying to look for receipts and paperwork. It’s an excellent idea to start a file in which you keep everything and anything that could be remotely related to your taxes.

There are all kinds of credits and deductions, so make sure you don’t leave things out that could qualify. Seeing a tax planning professional or buying a computer program to help with tax planning in the coming year is a strategic way to start the year organized and stay that way all the way through tax season. Tax pros and tax planning software offer information on the strategies that will result in a higher tax refund when tax time rolls around.

Software programs may offer either free phone or chat support, or charge an extra fee to speak with a CPA. An alternative option is to seek out a local tax professional or CPA and schedule a meeting so that they can provide a framework for organizing your tax information and offer recommendations for maximizing your tax savings. They, or you, will find credits and deductions you didn’t know you could take.

Reduce Exemptions and Find All of Your Deductions

Another thing to think about is changing your exemptions. If you’re employed by a company, you filled out a W-4 form when you were hired specifying the number of exemptions you wanted such as single, head of household, etc. The more exemptions you claim, the less money they withhold for taxes, so you could end up owing money at the end of the year. If you’re able to, change your exemption status to one so that your employer will withhold more money out of every check – but you’ll get more back at the end of next tax season.

Deductions are essential to ensuring a big tax refund. Be sure that throughout the year you keep very thorough and detailed records of the different deductions you plan to claim. Some of these deductions may include:

- Charitable donations: Cash donations are acceptable, and you can also donate clothing, household items, furniture, and many other items. If you volunteer and use your car to help the nonprofit, you can deduct your mileage. Make sure that the nonprofit can prove 501(c)(3) tax-exempt status.

- Mortgage interest

- Student loan interest

- Moving expenses

- Job hunting expenses

- Gambling losses

- Medical deductions: Keep in mind that you may need a letter on official letterhead from a healthcare provider documenting that certain medical equipment or supplies are medically necessary.

Have you thought about starting your own business? If you decide to start your own small business there are many deductions you can claim. Some of these deductions include:

- General office supplies

- Office equipment

- Home office expenses

- Telephone use

- Internet service

- Advertising

- Don’t forget to deduct the mileage used for your small business. If your business requires you to travel to different locations – such as a dog walking or dog sitting business, don’t forget to track your mileage so that you can use it for a deduction at the end of the year.

There are many other deductions you may be able to use, so a tax preparer or computer program are the best ways to make sure you don’t miss any of them, and to be sure that you do qualify for them.

Tax Credits and Your IRA

Tax credits are another great way to ensure a big tax refund. Some of the credits you can claim are:

- New homebuyer

- Energy-saving improvements

- Owning a hybrid vehicle

- Education credits

- Child and dependent care tax credits

- Earned income tax credit

If you don’t have an IRA you should open one. If you have one, make contributions to it and even max it out if you can.

Put It All Together

Consider using all of these tips in order to really minimize your tax obligations next year. Get a certified tax preparer, keep track of all receipts and paperwork, and learn what deductions and credits you can claim. When all is said and done, hopefully next year you’ll be on the receiving end of a check from the IRS.

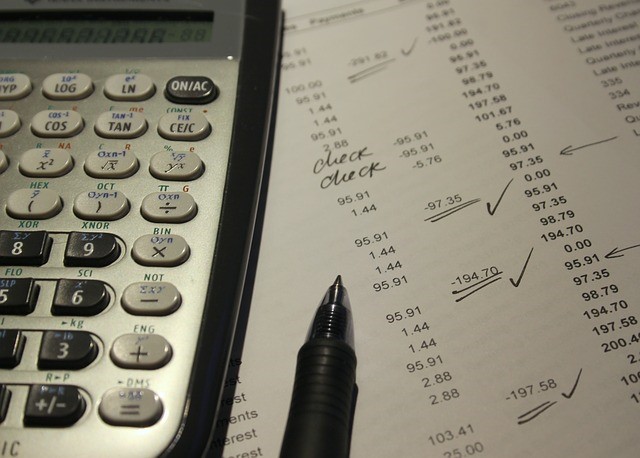

Image via Pixabay by 777546

Categories

Subscribe to Our Blog

Archive

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- September 2017

- June 2017

- April 2017

- October 2016

- July 2016

- May 2016

- April 2016

- February 2016

- November 2015

- September 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- August 2014

- July 2014

- July 2013

- May 2013

- February 2013

- December 2012

Talk to an expert

Want help finding the ideal meeting room? Give us a call

Book the Perfect Meeting Room Now

Find a Meeting Room